The Ultimate Guide to Selecting The Perfect Travel Insurance for Your 2023 Adventure

A Complete Guide to Buying The Best Travel Insurance in 2023

In this complete guide to buying the best travel insurance in 2023 article, we will look at all things travel insurance, from what to look for, when to look for it, and when’s best to get it. We’ll talk about the various cover options, what may suit your needs, specific types of travel cover, and lots more.

Travel Insurance – Ha, What Are You Worried About?

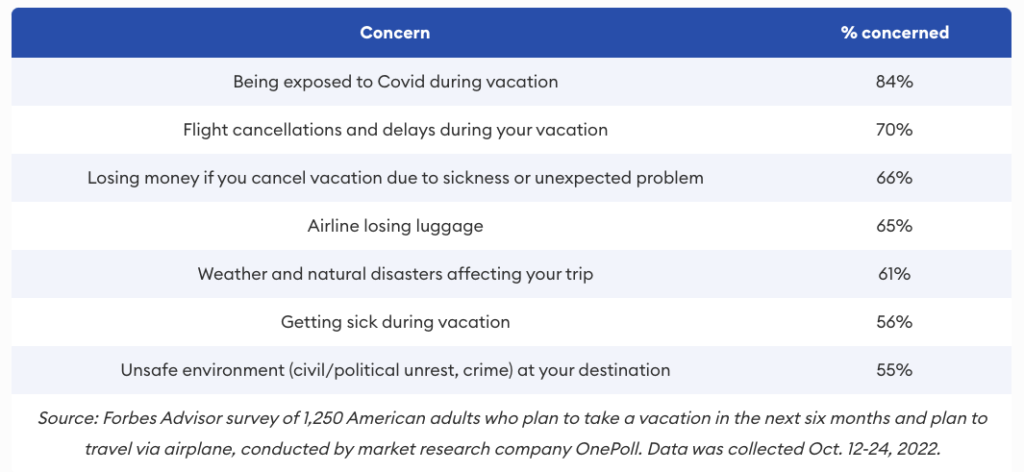

Well, in this survey by OnePoll taken in October 2022, travelers mentioned these were the seven main concerns…

A great vacation can turn sour very quickly.

Traveling outside of your native country can be really thrilling and liberating, but it can also be risky, and you might not be aware of the potential risks until you are actually in at the deep end and experiencing them, which can cause you a great deal of stress and aggravation. The best course of action is to safeguard against any mishaps, unforeseen illnesses, or injuries is to purchase travel insurance.

When my wife and I were sailing in the Caribbean, she discovered a lump in her breast. We were in a state of panic, we weren’t insured, and we were 5,000 miles from home. We went to the local health center on Union Island (population of 3,000 people) and saw a doctor. He arranged for us to see a specialist on the island of St Vincent.

We sailed to St Vincent, where we were seen by the pre-eminent breast cancer specialist in the Caribbean. She arranged for my wife to have a biopsy at the local hospital later that week. Luckily the lump wasn’t cancerous, and it was removed.

We were very fortunate that this consultation and surgery were completely free. We only had to pay for post-operative medication. We have nothing but praise for the people who looked after us.

But, if this had occurred in many other countries we would have faced huge medical bills. The cost of the operation alone in the US would have been between $4,000 and $10,000.

As I said, things happen, and it’s generally best to cover your bases and take out the necessary cover beforehand.

Big-box travel agencies’ insurance policies

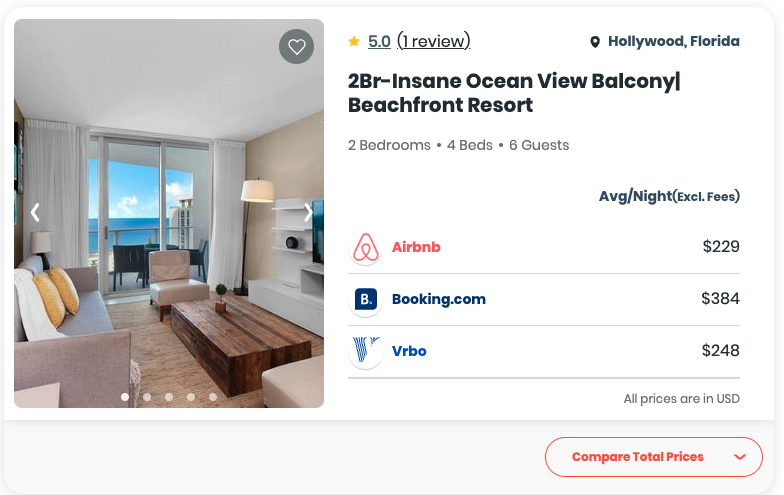

First off, as we are a vacation rental price comparison site, we’ll look at big-box brands like Airbnb. Booking (.com), VRBO, and the like.

Each of these companies offers some sort of insurance, but to be honest, you don’t really get much, if any, actual travel insurance.

Airbnb and VRBO offer promises that assure the traveler gets what they have paid for, and they will help if that isn’t the case. In both cases, this is more assurance than insurance.

Click on the tabs below to discover what each company offers.

If you take out extra insurance coverage with one of these companies, check your credit card payment to make sure that payment went through and save copies of all correspondence. There have been cases where travelers paid for extra cover, but they weren’t insured.

See this article for more details

Let’s start with Airbnb, as they are the biggest brand in the short-term rental space.

Anyone who books through Airbnb gets their AirCover. It’s included in the price of the booking, so we’re off to a good start.

What you get

Their site says you can “Travel with peace of mind when you book on Airbnb.”

The most comprehensive protection in travel. Always included, always free.

Cancellation options make it easy to re-book if your plans change.

Talk to our support team from anywhere in the world, any hour of the day.

1. Booking Protection Guarantee

In the unlikely event a Host needs to cancel your booking within 30 days of check-in, we’ll find you a similar or better home, or we’ll refund you.

2. Get-What-You-Booked Guarantee

If at any time during your stay you find your listing isn’t as advertised—for example, the refrigerator stops working and your Host can’t easily fix it, or it has fewer bedrooms than listed—you’ll have three days to report it and we’ll find you a similar or better home, or we’ll refund you.

3. Check-In Guarantee

If you can’t check into your home and the Host cannot resolve the issue, we’ll find you a similar or better home for the length of your original stay, or we’ll refund you.

4. 24-hour Safety Line

If you ever feel unsafe, you’ll get priority access to specially-trained safety agents, day or night.

As they say, these things are always included and always free, so that’s great, but the degree of cover falls well short of their headline The most comprehensive protection in travel.

You are going to need additional insurance if you want to be covered for medical emergencies, travel disruptions, and the like.

After much searching, we can’t find much information on what, if any, travel insurance BDC provides. They do have links to their Travel Communities where travelers can discuss insurance issues, but TBH the conversations and replies from BDC don’t fill you with confidence.

You can find those discussions here.

VRBO offers their Book with Confidence Guarantee.

Here’s what they say about it on their website, followed by what you get…

From the moment you book until your trip is over, we’re here to help your stay go right. Learn more about our Book with Confidence Guarantee and other benefits that we provide every time you book and pay through Vrbo.

Before your stay

Here’s how we protect your trip before it even begins.

Selecting Premier Hosts

Our Premier Hosts consistently provide great experiences for their guests. When you see Premier Host on a property, you can feel more confident about the property description, photos, and amenities.

Protecting your payments

When you pay through Vrbo, we protect your rental payment against fraud. If your payment ends up in the hands of someone other than the host, we’ll pay you back.

How to pay securely

Screening for fraud

Verified accounts, background checks, and fraud checks are a few of the ways that we are screening for fraud.

Re-booking when you need it

It doesn’t happen often, but if a host has to cancel a booking at the last minute, we have dedicated re-booking specialists here to help you book similar accommodation.

During your stay

We’re here to help your stay go smoothly.

Helping you with our dedicated care team

Our experts are available to answer any questions that come up during your stay. If you need help contacting the host or just have some questions, we’re here to help. Visit help centre

Lodging if you’re in need

If you can’t get into the property or if you discover that it was significantly misrepresented online (fewer bedrooms, material defects, etc.), let us know in the first 12 hours. We’ll try to find you new accommodation so your trip can go on smoothly.

After your stay

Even after your trip is over, we’re still here to help.

Protecting your damage deposit

If the host wrongfully withholds your damage deposit after your stay, we’ll help you get it back.

VRBO also offers a couple of upsells to their Book with Confidence Guarantee. These are provided by Europe Assistance and underwritten by Generali Group and include,

Cancellation Protection

Get reimbursed for non-refundable trip costs if you have to cancel because of illness, injury, weather-related cancellations, theft of visa or passport, or involuntary loss of employment.

and,

Damage Protection

Get additional protection from extra expenses due to accidental damage to the property during your trip.

You can learn more about these options here.

Should you need to file a claim, visit the Generali e-claims portal. If you’d prefer to call, you can reach Europe Assistance at +44 788 86 52.

Common Travel Insurance FAQs

To avoid unforeseen troubles later, obtaining the appropriate insurance policy is crucial. There are specific procedures every buyer should follow to ensure they are outfitted with the necessary coverage.

We recognize that purchasing travel insurance can be challenging, and you will have many questions.

So, before we start looking in detail at the ins and outs of travel insurance, here are a few frequently asked questions about travel insurance:

Well, the short answer is no. You aren’t legally bound to have travel insurance, but you may well feel the need to get it.

Many factors come into play here. The distance you are traveling, the length of stay, and the vacation cost.

You are less likely to need cover for a weekend break at a drive-to destination than you are on a long haul, one-month stay in a less developed country.

At the end of the day, it comes down to personal choice but…

To protect yourself from unforeseeable events like trip cancellation, flight delays, or interruptions, medical crises, and lost or stolen luggage, it’s a good idea to think about getting travel insurance. Your individual travel demands and plans will determine whether you need travel insurance or not.

The devil is in the detail here; you generally get what you pay for. Go cheap, and you may well have issues when filing a claim.

Travel insurance packages can offer a wide range of advantages and customized coverage. Travel cancellation and interruption, medical care, baggage, and personal property coverage, and travel delays and interruption coverage are a few examples of common forms of insurance.

To know what is and isn’t covered by insurance, it is crucial to thoroughly read the terms and conditions.

You will come across this last sentence time and time again in this article. Please, please, please, pay attention to what you are and aren’t covered for – Before signing on the bottom line.

Generally speaking, you can buy travel insurance anytime before your trip. Although some policies may have a deadline for purchasing coverage, it’s typically a good idea to buy travel insurance as soon as you arrange your trip.

You’ll typically need to provide documentation, such as a copy of your ticket, a statement from the airline or other pertinent party indicating the reason for the claim, and receipts for any additional costs you incurred as a result of the problem, in order to submit a claim with your travel insurance provider.

Along with providing the necessary evidence to the insurance company, you must also fill out a claim form. To learn the precise procedures contact your insurance provider.

The precise terms and conditions of the policy will determine whether or not pre-existing medical issues are covered by travel insurance. Pre-existing conditions may not be covered by all policies, while others may offer either limited coverage or necessitate the purchase of supplementary coverage for them.

Once again, before obtaining insurance, it’s crucial to carefully read the terms and conditions to understand what is and isn’t covered.

What is typically covered by a standard travel insurance policy?

Although the particular benefits and coverage provided by a typical travel insurance policy might differ substantially from provider to provider, the following are some samples of what might be covered:

Trip interruptions and cancellations: This might cover the expenses associated with postponing or canceling a trip due to unforeseeable events like illness, accidents, or natural disasters.

Medical coverage: If you get sick or hurt while traveling, this can pay for your medical care and/or evacuation costs.

The expense of lost, damaged, or stolen luggage and personal property may be covered under the baggage and personal property policy.

In the event that your flight is delayed or disrupted, this coverage may pay for additional lodging costs and transportation costs.

A type of insurance called trip cancellation coverage can assist in reimbursing the costs associated with postponing a vacation due to unanticipated events like illness, injury, or natural disasters.

A few examples of what trip cancellation insurance might cover are as follows:

Flights, hotels, tours, and other non-refundable travel expenses might be included in this category.

Costs associated with pre-paid activities or events, such as concert or sporting event tickets, can be included in this category.

Additional costs: If you need to cancel your trip due to an unforeseen event and cannot travel as scheduled, this could include additional lodging or transportation costs.

If your vacation is delayed due to unforeseeable events like flight delays or natural catastrophes, trip delay coverage is a type of insurance that can cover the cost of additional lodging and transportation costs.

A few examples of what trip delay insurance might cover are as follows:

Journey delay coverage can assist with the cost of these expenditures if you need to make new hotel reservations due to a delay in your trip.

Trip delay coverage can help with the cost of these if you need to buy additional tickets due to a trip delay, such as new flights or train tickets.

Meals and incidentals: Should your travel plans be postponed, trip delay insurance may be able to assist with the cost of meals and other unforeseen expenses while you wait for your travels to proceed.

A travel insurance policy may include certain sorts of coverage, such as medical costs and emergency evacuation benefits.

If you are sick or hurt while traveling, medical expenditures coverage can help pay for the cost of medical care and/or emergency transportation. This can cover the price of things like ambulance transportation, hospital stays, and medical procedures like surgery or medicines.

In the event of a medical emergency, emergency-evacuation coverage can assist in paying for your transportation to a medical institution. This may cover the price of specialist transportation services, such as an air ambulance.

The particular benefits and coverage provided by medical expense and emergency-evacuation insurance might differ significantly, so it’s crucial to carefully research the terms and conditions of a policy before buying it. It’s a good idea to become aware of any exclusions or coverage limitations in your policy before you go.

Additionally, it’s a good idea to become familiar with the medical services and facilities that are offered at your location. You should also keep the contact information of your travel insurance company on hand in case of an emergency.

Also, see the existing medical conditions and specialist travel insurance sections.

In the event that your luggage is stolen, lost, or otherwise harmed while in transit during your vacation, baggage loss travel insurance normally pays for the expense of replacing your personal possessions.

This can apply to things like apparel, gadgets, jewelry, and personal papers. It’s critical to study the coverage details before buying insurance because the coverage and reimbursement limits will differ depending on the particular policy.

Some policies may have restrictions, such as paying out only a particular amount for each item and having a maximum claim amount.

How is the price of travel insurance calculated?

On average, a basic travel insurance policy for a one-week domestic trip can cost anywhere from $30 to $50, while a more comprehensive policy for an international trip can cost several hundred dollars.

It’s essential to keep in mind that the cheapest option may not always be the best one. It’s important to compare the coverage offered by different policies and choose the one that best fits your needs and budget. It’s also important to shop around and compare prices from different insurers to make sure you are getting the best deal possible.

It’s good practice to make a comparison between different providers and their coverage because it can give you a better understanding of the market and a fair price.

What types of travel insurance policies are available?

Single-trip policies, also known as “one-time” or “short-term” travel insurance policies, are designed to provide coverage for a specific trip. They are typically used by people who are planning a single, upcoming trip and want coverage for that specific trip only.

Single-trip policies typically provide coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay. The coverage and reimbursement limits will vary depending on the specific policy, so it’s important to review the details of the coverage before purchasing a policy.

Single-trip policies can be purchased to cover a range of trip lengths, from a weekend getaway to a several months long trip, it all depends on the insurance company policy, most have the flexibility to adjust coverage and duration.

It’s a good option for those who do not travel frequently, but for frequent travelers, an annual policy might be more cost-effective (see below).

It’s important to purchase a policy before you leave for your trip as most policies will only cover events that happen after the policy is purchased. It’s also essential to read the fine print and understand what is covered and what is not.

Annual multi-trip policies, also known as “multi-trip” or “annual” travel insurance policies, are designed to provide coverage for an unlimited number of trips taken within one year. They are typically used by people who travel frequently throughout the year and want coverage for all of their trips during that time.

Annual multi-trip policies typically provide coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay, similar to single-trip policies. The coverage and reimbursement limits will vary depending on the specific policy, so it’s important to review the details of the coverage before purchasing a policy.

These policies can be a cost-effective option, especially for frequent travelers, as the cost is averaged out over the year. It can save you the time and effort of having to purchase a separate policy for each trip. Some annual multi-trip policies may have a maximum trip duration, which means that all the trips you take within that time frame need to be shorter than the time defined on the policy.

Like single-trip policies, it’s important to purchase a policy before you leave for your trip and read the fine print to understand what is covered and what is not. And always make sure the policy you choose offers coverage for the countries you will be traveling to.

The decision to choose a single-trip or multi-trip policy will depend on your individual travel needs and habits.

If you only take one or a few trips per year, a single-trip policy may be the better option for you. It will provide coverage for the specific trip you are taking, and you won’t have to pay for coverage you don’t need if you’re not traveling during the rest of the year.

On the other hand, if you travel frequently throughout the year, an annual multi-trip policy may be more cost-effective and convenient. This type of policy will provide coverage for an unlimited number of trips taken within a one-year period, so you don’t have to purchase a separate policy for each trip. This can save you time and money, especially if you take several trips per year.

Also, it’s worth noting that some annual multi-trip policies have a maximum trip duration, meaning that each trip you take within that time frame needs to be shorter than the time defined on the policy. So, if you’re planning on a long trip make sure you check the terms and conditions for the coverage.

Ultimately, the decision will depend on your own travel habits, budget, and the type of coverage you need. I recommend comparing the coverage and pricing of both options and carefully reviewing the terms and conditions to determine which type of policy is the best fit for you.

Backpacker travel insurance is a type of travel insurance that is specifically designed for backpackers and budget travelers. It is often considered as an extended version of a standard travel insurance policy that is tailored to the specific needs of backpackers.

Backpacker travel insurance typically provides coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay. Additionally, it might also provide coverage for outdoor activities like hiking, camping, and rock climbing which are not typically covered by a standard travel insurance policy.

See below for specialist travel insurance policies.

Backpacker travel insurance policies often offer more flexible options, such as long-term coverage (up to a year or more) and the ability to extend coverage while traveling. It’s also common that they have higher coverage limits than standard travel insurance policies. This can make them an ideal choice for backpackers who may be planning to travel for an extended period of time and participate in more adventurous activities.

The coverage and reimbursement limits will vary depending on the specific policy, so it’s important to review the details of the coverage before purchasing a policy. It’s important to keep in mind that the cheapest option may not always be the best one, and you should choose a policy that covers the specific activities and destinations you’ll be visiting.

Family travel insurance is a type of travel insurance that is designed to provide coverage for families traveling together. It is similar to a standard travel insurance policy but often includes additional coverage and benefits that are tailored to the needs of families.

Family travel insurance typically provides coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay, similar to a standard travel insurance policy. But it often have higher coverage limits, and some policies may cover children and other dependents, who are typically not covered under a standard travel insurance policy.

Additionally, some family travel insurance policies may include coverage for additional events, such as the illness or injury of a close relative at home, which could cause you to cancel your trip; this coverage is not typically included in a standard policy.

Family travel insurance can be a good choice for families who are planning to travel together and want to ensure that everyone is covered in case of an emergency. However, it’s important to review the details of the coverage before purchasing a policy and compare the pricing and coverage between different providers to make sure you are getting the best deal possible.

European travel insurance and Worldwide travel insurance are types of travel insurance that provide coverage for travelers visiting specific regions or areas of the world.

European travel insurance typically provides coverage for travelers visiting European countries. The coverage and reimbursement limits will vary depending on the specific destinations and policy, but generally, it includes coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay, similar to a standard travel insurance policy.

Worldwide travel insurance, on the other hand, provides coverage for travelers visiting any country around the world, regardless of the region. The coverage will typically be the same as a standard travel insurance policy, and it can include things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay.

Exclusions

It’s worth noting that some policies may have some exclusions, and not all countries might be covered or have the same level of coverage.

Obviously, some countries are seen as high-risk, and these will most likely be excluded from such policies. You can see an up-to-date list of high-risk countries here. It’s a surprisingly long list.

It’s important to review the details of the coverage before purchasing a policy, and make sure the policy you choose offers coverage for the countries you will be traveling to.

Both of these types of travel insurance can be a good choice for travelers who are planning to visit specific regions or areas of the world, but it’s important to check the terms of the policy, including geographic coverage limits and exclusions, before purchasing a policy to ensure that it meets your needs.

Specialist travel insurance policies

Specialist travel insurance policies are a type of travel insurance that is designed to provide coverage for travelers with specific needs or who are participating in specific activities. Some examples of specialist travel insurance policies include:

- Adventure travel insurance

- Senior travel insurance

- Winter sports travel insurance

- Group travel insurance

- Cruise travel insurance

- Pre-existing medical conditions travel insurance

- Business travel insurance

Specialist travel insurance policies can provide additional coverage and benefits that are not typically included in a standard travel insurance policy.

It’s essential to review the details of the coverage before purchasing a policy and compare the pricing and coverage between different providers to make sure you are getting the best deal possible.

Additionally, make sure the policy covers the specific activities and destinations you’ll be visiting.

Adventure travel insurance is a type of travel insurance that is specifically designed for travelers who are participating in activities such as hiking, rock climbing, skiing, or other adventure sports. It is often considered an extended version of a standard travel insurance policy that is tailored to the specific needs of adventure travelers.

Adventure travel insurance typically provides coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation, and repatriation. But it often has higher coverage limits than standard travel insurance policies since the risks associated with adventure travel are typically higher.

In addition to standard coverage, adventure travel insurance may also provide coverage for additional risks such as:

- Emergency evacuation: This coverage can help with the cost of getting you to a safe place in the event of an emergency while participating in an adventure activity.

- Search and rescue: This coverage can help with the cost of a search and rescue operation if you are injured or lost while participating in an adventure activity.

- Rental equipment: This coverage can help with the cost of replacing rental equipment that is lost, stolen, or damaged while participating in an adventure activity.

- Hazardous sports: Coverage for specific activities like bungee jumping, white-water rafting, paragliding, etc.

It’s important to note that adventure travel insurance does not cover every possible risk, and it can vary depending on the policy you choose. Policies may have exclusions and limitations, so it’s essential to review the details of the coverage before purchasing a policy and make sure the policy you choose offers coverage for the specific activities you will be participating in.

Senior travel insurance is a type of travel insurance that is specifically designed for older travelers who may have additional health concerns or may require additional coverage. It is similar to a standard travel insurance policy but often includes additional coverage and benefits that are tailored to the needs of seniors.

Senior travel insurance typically provides coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay, similar to a standard travel insurance policy.

In addition to standard coverage, senior travel insurance may also provide coverage for additional risks such as:

- Pre-existing medical conditions: This coverage can help with the cost of medical treatment for pre-existing conditions that may arise while traveling.

- Medical evacuation: This coverage can help with the cost of getting you to a hospital or other medical facility in the event of an emergency while traveling.

- Acute onset of pre-existing conditions: This coverage can help with the cost of medical treatment for a pre-existing condition that arises unexpectedly while traveling.

- Repatriation of remains: This coverage can help with the cost of returning your remains to your home country if you die while traveling.

It’s important to note that senior travel insurance does not cover every possible risk, which can vary depending on your chosen policy.

Policies may have exclusions and limitations, so it’s essential to review the coverage details before purchasing a policy and compare the pricing and coverage between different providers to ensure you are getting the best deal possible.

Additionally, some policies may have age limitations, which means that the coverage only applies to travelers over a certain age. It’s essential to check the terms of the policy before purchasing a policy to ensure that it meets your needs and you’re eligible for the coverage.

Winter sports travel insurance is a type of travel insurance specifically designed for travelers participating in winter sports such as skiing or snowboarding. It is often considered an extended version of a standard travel insurance policy tailored to winter sports travelers’ specific needs.

Winter sports travel insurance typically provides coverage for things like trip cancellation, trip interruption, emergency medical expenses, emergency evacuation and repatriation, and baggage loss or delay, similar to a standard travel insurance policy.

In addition to standard coverage, winter sports travel insurance may also provide coverage for additional risks such as:

- Ski lift closures: this coverage can help with the cost of accommodations and transportation if the ski lifts are closed due to inclement weather or other reasons.

- Ski equipment rental: this coverage can help replace rental equipment lost, stolen, or damaged while participating in a winter sport.

- Avalanche and other mountain-related risks: this coverage can help with the cost of rescue and evacuation in case of an avalanche or other mountain-related emergency

- Piste closure: this coverage can help with the cost of accommodations and transportation if the ski slopes are closed due to inclement weather or other reasons.

It’s important to note that winter sports travel insurance does not cover every possible risk, which can vary depending on your chosen policy.

Policies may have exclusions and limitations, so review the coverage details before purchasing a policy and compare the pricing and coverage between different providers to ensure you get the best deal possible.

Group travel insurance typically covers a range of potential risks associated with traveling as a group, such as trip cancellations, medical emergencies, accidental death or injury, and lost or stolen baggage. It may also provide additional coverage, such as emergency evacuation and repatriation, trip interruption, and accidental death and dismemberment.

The exact coverage offered by a group travel insurance policy will depend on the specific policy and the insurer.

Cruise travel insurance typically covers a range of potential risks associated with traveling on a cruise, such as trip cancellations, medical emergencies, accidental death or injury, and lost or stolen baggage. It may also provide additional coverage, such as emergency evacuation and repatriation, trip interruption, and accidental death and dismemberment.

Some policies may also cover the cost of a missed port of call or the cost of returning to the port of departure if a passenger becomes ill or injured. A cruise travel insurance policy’s exact coverage will depend on the policy and the insurer.

It will also depend if the policy covers the cruise itself or if it only covers a passenger before and after the cruise. Some policies also have specific coverage for incidents or events that could happen on board the ship.

If you have a pre-existing medical condition and you’re planning to travel, it’s a good idea to consider getting travel insurance that covers pre-existing medical conditions. This type of coverage will provide protection for your condition, such as medical treatment and emergency evacuation, in case something happens while you’re traveling.

Without this type of coverage, you may not be fully protected if you require medical attention while you’re away, which could lead to a significant financial burden. It’s best to review the policy and the fine print. Many policies have exclusions or limit coverage for pre-existing medical conditions.

It’s also important to remember that most travel insurance policies have a waiting period before coverage starts, so it’s best to purchase your policy as soon as you book your trip and make sure to disclose your pre-existing condition to the insurer.

You should also carry enough medication and provide contact information for your healthcare provider and any special needs you might have. It’s always important to check if the destination you are going to has adequate medical care and facilities.

Business travel insurance is not a requirement, but it can provide valuable protection for a company’s employees and assets while they’re traveling for business.

Some of the benefits of having business travel insurance include the following:

- Providing medical coverage for employees in case of accidents or illnesses while traveling.

- Covering the cost of emergency medical evacuation and repatriation.

- Protecting the company against financial losses due to trip cancellations or interruptions.

- Providing coverage for lost or stolen baggage and personal effects.

- Covering the cost of legal representation and bail if an employee is arrested or detained.

It’s important to note that standard travel insurance policies may not cover all the specific risks and exposures a business traveler can face. Therefore, getting a business travel insurance policy tailored to the needs of the company and its employees is a good idea. This will ensure that everyone is protected while traveling and that the company’s assets are also covered.

Ultimately, whether or not a company needs business travel insurance will depend on the specific circumstances and risks involved with the company’s travel operations. A good idea is to consult with a specialist who can help you identify the risks and recommend the appropriate coverage.

Other commonly asked questions

Will my credit card offer built-in travel protection?

Many credit cards offer built-in travel protection as a benefit to cardholders. These benefits can include coverage for trip cancellation or interruption, lost or stolen luggage, emergency medical expenses, and rental car collision damage. However, the specific benefits and coverage amounts can vary depending on the credit card issuer and the type of card.

It’s important to check the terms and conditions of your credit card to see what types of travel protection are offered. Some credit cards only offer these benefits to certain cardholders, or only offer coverage under certain conditions. Additionally, while credit card travel insurance may provide some coverage, it may not be as extensive as a standalone travel insurance policy, and may also have restrictions on coverage.

It’s also important to note that credit card travel protection may not cover pre-existing medical conditions, which is a common exclusion in travel insurance. It’s always a good idea to review the coverage offered by your credit card and compare it to the coverage offered by a standalone travel insurance policy to determine which option is best for you.

Common travel insurance exclusions

It’s essential to pay attention to what isn’t covered on your travel insurance policy and what is, so there are no surprises if you need to make a claim.

In 2020, the coronavirus pandemic disrupted travel massively and caused some insurers to stop selling policies altogether.

- Pre-existing medical conditions: Many travel insurance policies exclude coverage for medical expenses related to pre-existing conditions.

- High-risk activities: Some policies may exclude coverage for injuries or accidents sustained while participating in high-risk activities such as bungee jumping, skiing, or scuba diving.

- Intentional acts: Most policies will not cover injuries or damages resulting from intentional or criminal acts.

- Alcohol or drug use: Many policies exclude coverage for injuries or accidents that occur while under the influence of alcohol or drugs.

- Lack of documentation: Travel insurance policies often require that you have proper documentation, such as a police report, in order to make a claim.

- Natural Disaster: Policies may not cover for losses caused by natural disaster such as floods, hurricanes or earthquakes.

- Financial default: Some policies may not cover for losses resulting from the financial default of a travel supplier, such as a tour operator or airline.

- Fraud or misrepresentation: Travel insurance policies typically exclude coverage for losses resulting from fraud or misrepresentation on the part of the policyholder.

- War or terrorism: Many policies exclude coverage for losses resulting from war or acts of terrorism.

- Government-imposed restrictions: Policies may not cover losses resulting from government-imposed restrictions such as travel bans or flight cancellations due to political unrest.

It’s important to always check the specific terms and conditions of your policy and to be aware of any exclusions that may apply.

I’m pregnant – do I need specialist travel insurance?

If you are pregnant, it is recommended that you purchase specialist travel insurance. Standard travel insurance policies may not cover any complications or issues related to pregnancy, and may also have restrictions on travel during the later stages of pregnancy. On the other hand, specialist travel insurance policies are designed to provide coverage specifically for pregnant travelers and may include coverage for medical expenses related to pregnancy, as well as trip cancellation or interruption due to pregnancy.

It is important to inform your insurance provider about your pregnancy and your travel plans, as some providers will have specific requirements for coverage. It is also important to check that your policy covers you for the entire duration of your trip and any activities you plan to do while on vacation.

It is also important to check with your doctor if it is safe to travel during your pregnancy and inform your travel insurance provider of the expected due date. Some policies may restrict travel after a certain point in the pregnancy.

To wrap it up…

Who are the top 5 travel insurance companies?

There are many travel insurance companies to choose from, and the top companies may vary depending on the region and the source you’re looking at. However, some of the most well-known and reputable travel insurance companies include:

- Allianz Global Assistance – A well-known provider of travel insurance with a variety of policies to choose from.

- World Nomads – a travel insurance company that specializes in providing coverage for travelers and backpackers.

- AXA – one of the largest global insurers, offers a wide range of travel insurance policies, including coverage for pre-existing medical conditions.

- Travelex Insurance Services offers a range of travel insurance policies and services, including emergency medical care and trip interruption coverage.

- Travel Guard – Known for providing coverage for emergency medical care, trip interruption, and other travel-related issues.

It’s important to note that above mentioned are just an example and not a ranking, and it’s always best to do your own research and compare the different policies and coverage options offered by different companies before choosing a travel insurance provider.

Can I cancel my travel insurance policy?

Yes, you can cancel your travel insurance policy. The process and fees for canceling will vary depending on the insurance provider and the specific policy.

You will typically need to contact the insurance provider and provide written notice of your intent to cancel. Be sure to review the terms and conditions of your policy, as some policies may have specific requirements or fees for canceling.

How do I find the right policy – at the best price?

How do I find the right policy – at the best price?

Finding the right travel insurance policy at the best price can take some research and comparison shopping. Here are a few tips that can help:

- Identify your needs: Before shopping for a policy, consider what types of coverage you need. Are you looking for protection against trip cancellation, medical expenses, or lost luggage? Knowing what you need will help you narrow down your options.

- Compare policies and prices: Look at different insurance providers and compare the coverage and prices of their policies. Use insurance comparison websites to make your research easier.

- Read the fine print: Carefully review each policy’s terms and conditions to ensure you understand what is and is not covered. Pay particular attention to any exclusions or restrictions that may apply.

- Look for discounts: Some insurance providers offer discounts for purchasing a policy online or for purchasing multiple policies at once.

- Check for any pre-existing condition coverage: If you have any pre-existing medical conditions, it is important to check that the policy you are considering covers for them.

- Check for the level of coverage: Be sure to check that the policy you choose covers you for the entire duration of your trip and for any activities you plan to do while on vacation.

- Check for additional benefits: Some policies may offer additional benefits such as emergency travel assistance, 24-hour customer service, or coverage for lost or stolen passports.

By following these tips, you should be able to find a policy that meets your needs and fits your budget.

Alan has been working in the vacation rental sector since 2004, when he first created a listing site for his property management company. He has been helping short-term rental owners and managers to stand out in an over-saturated marketplace for over 12 years and has written thousands of articles in that time.

He has written books on vacation rental photography and was the first in the industry to create online marketing courses for hosts.

He has given keynote presentations across various subjects at The Vacation Rental World Summit, VRMA, VRMintel, Host, and The Book Direct Summit.